In November 2021, ICG was among the first alternative asset managers to have targets approved by the SBTi. We are pleased to provide an update on the progress made since we first set our targets and will continue to enhance our reporting, particularly on relevant investments, as an industry-wide approach is adopted over time.

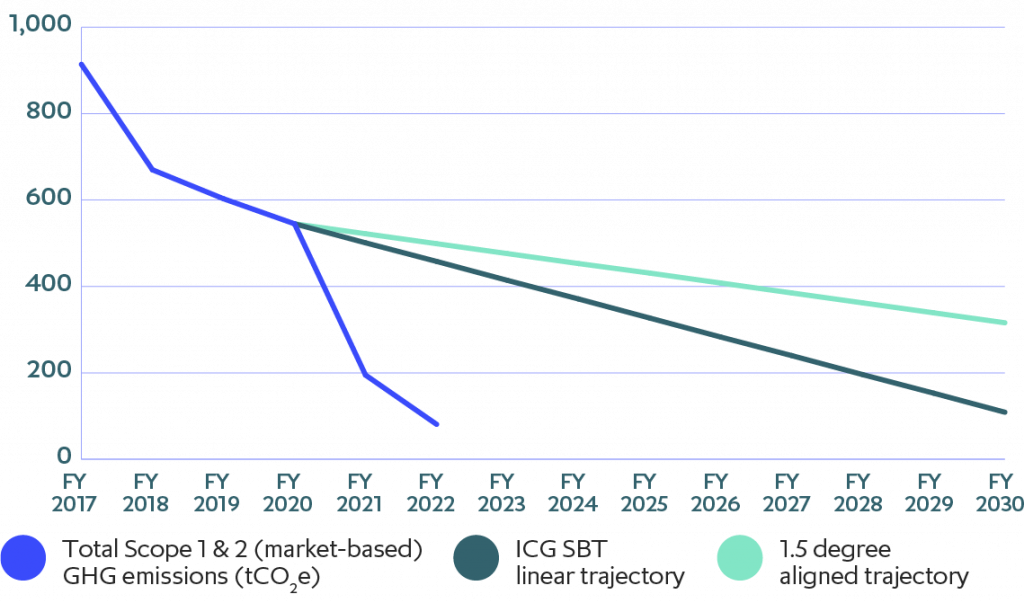

Scopes 1 and 2 – Absolute emissions reduction target

ICG commits to reduce absolute Scope 1 and 2 GHG emissions 80% by 2030 from a 2020 base year.

During FY22, our Group Scope 1 and 2 (market-based) emissions decreased by 85% compared to FY20 baseline, primarily due to a rise in the number of offices procuring 100% renewable electricity. While this means we have already achieved our Scope 1 and 2 SBT, we remain determined to sustain this performance over time as the firm continues to grow and expand its presence globally.

Group Scope 1 & 2 (market-based) greenhouse gas (GHG) emissions (tCO2e)

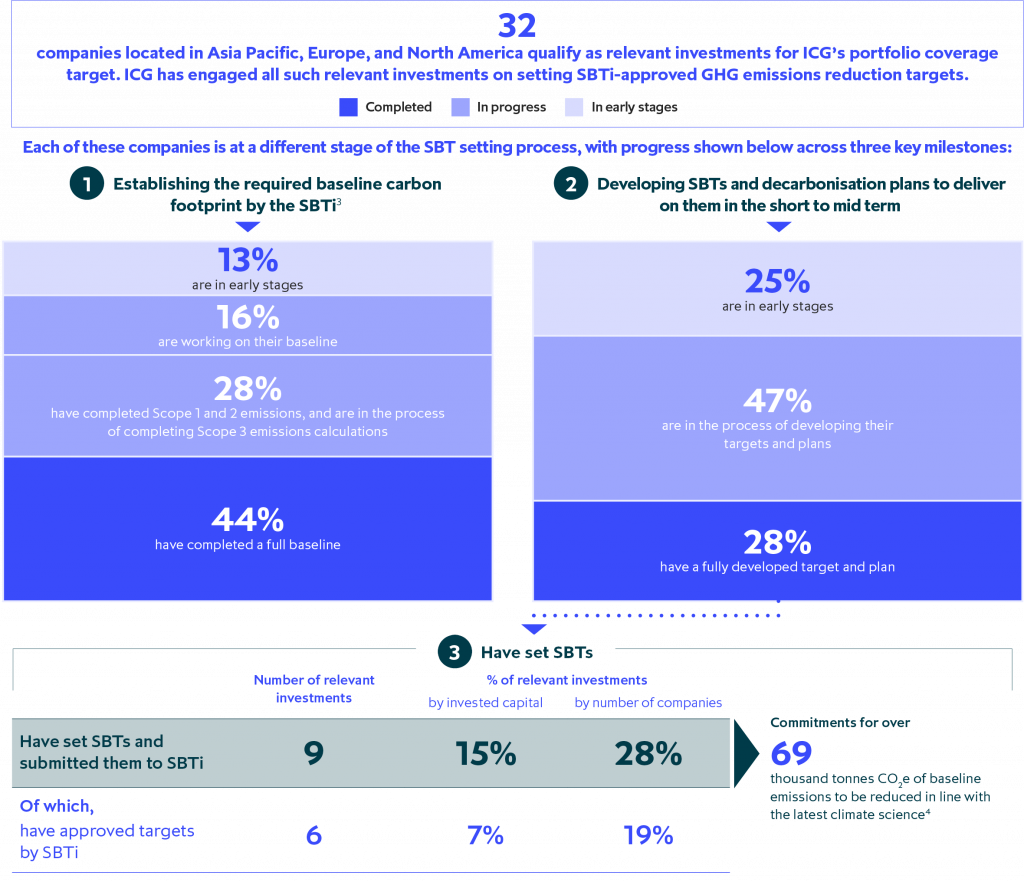

Scope 3 – Portfolio coverage target

ICG commits that 50% of its relevant Structured and Private Equity, and Real Assets direct investments by invested capital will have set science-based targets by 2026 and 100% by 2030 from a 2021 base year.

In November 2021, building on years of focus on engaging portfolio companies on climate change, we began implementing a dedicated SBT engagement programme with relevant investments to:

- Socialise what the science-based targets are, how they can be developed, and the benefits to companies, namely further building business resilience and encouraging greater innovation.

- Support portfolio companies in establishing their carbon footprint baseline, following the GHG Protocol. Often this involved educating management teams about the fundamentals of carbon footprinting and recommending third-party climate advisors and/or solutions to support them in completing their baseline assessment; and building the capability to monitor progress in the future.

- Input into the development of science-based targets and emissions reduction action plans to ensure these are ambitious, yet feasible to achieve and aligned with the business plan for our investment.

- Have such targets approved by the SBTi.

- Support the implementation of decarbonisation initiatives through sharing networks, ideas and best practices across our portfolios.

As at 31 December 2022, we have engaged with all 321 portfolio companies across five investment strategies2 qualifying as relevant investments; representing nearly $8bn of invested capital.

- Relevant investments that were in our portfolios at the time of setting our portfolio coverage target that are still in the portfolio as at 31 December 2022. Note that the SBTi currently does not validate and approve SBTs for educational institutions, so three portfolio companies in this sector have been excluded from our update.

- These are European Corporate, Asia Pacific Corporate, European Mid-Market, North America Private Equity, and Infrastructure Equity.

- Percentages are calculated based on number of companies in the respective stages, and may not add to 100% due to rounding.

- As per the applicable SBTi requirements for target setting and validation, as of 31 December 2022.

Go deeper

- Watch portfolio companies at different stages of setting SBTs, talking about their experience

- See how we are working towards net zero

- Nature loss is inextricably linked to the climate crisis – find out more