We know that transparency on ESG matters is of increasing importance to our clients. Recognising that ESG reporting by private companies is still a nascent practice, we have focused on two key initiatives over the last year: developing a proprietary ESG risk rating and participating in the CDP private markets pilot in an attempt to improve the availability and consistency of climate-related metrics.

ICG’s proprietary ESG rating

External ESG ratings currently provide only limited coverage of the Credit Fund Management platform’s investment universe. This is, however, evolving as ESG ratings are expanded gradually to cover private market issuers. We are in ongoing discussions with key providers and are monitoring progress closely.

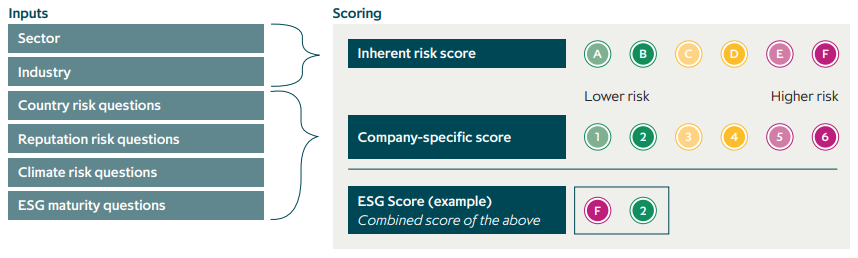

To address this gap, we are working with an external advisor to develop our own proprietary ESG rating. For each investment opportunity we will assess and rate both its inherent sector risk and company specific risks. This will be done by utilising the information collated through our existing ESG processes and tools, specifically our ESG Screening Checklist and Climate Risk Assessment, and by incorporating additional questions on the maturity of approach to ESG matters of each company.

The internal ESG rating will enable us to not only assess ESG related risks for each potential investment but will also help to inform and guide our ESG engagement and reporting to investors.

Overview of ESG rating — Illustrative output

Carbon emissions reporting

CDP private markets technical working group

We are currently in the process of rolling out fund-specific ESG reporting and expect to introduce these across our flagship, open-ended funds in H1 2022.

Reporting climate risks and carbon emissions data is a key focus for ICG and we are a member and active participant of the CDP Private Markets Technical Working Group. The aim is to improve the availability and consistency of climate-related metrics and facilitate benchmarking of climate-related data across the private market.