In this 12th bi-annual edition of the ICG Private Company Trends report, our clients can explore an in-depth view of the key fundamental trends we are seeing across this historically opaque segment of the market and our assessment of the outlook for the remainder of 2024.

Email [email protected] to request a copy of the IGC client-only report.

Summary of key trends

- Europe and US private companies maintained strong performance through 2023 and through H1 2024, with sales and EBITDA growth holding above pre-Covid levels and debt metrics remaining sound.

- Sales growth continued to slow through the second half of 2023 as growth normalised from the exceptional post-Covid lockdown growth rates of 2022 and price growth moderated.

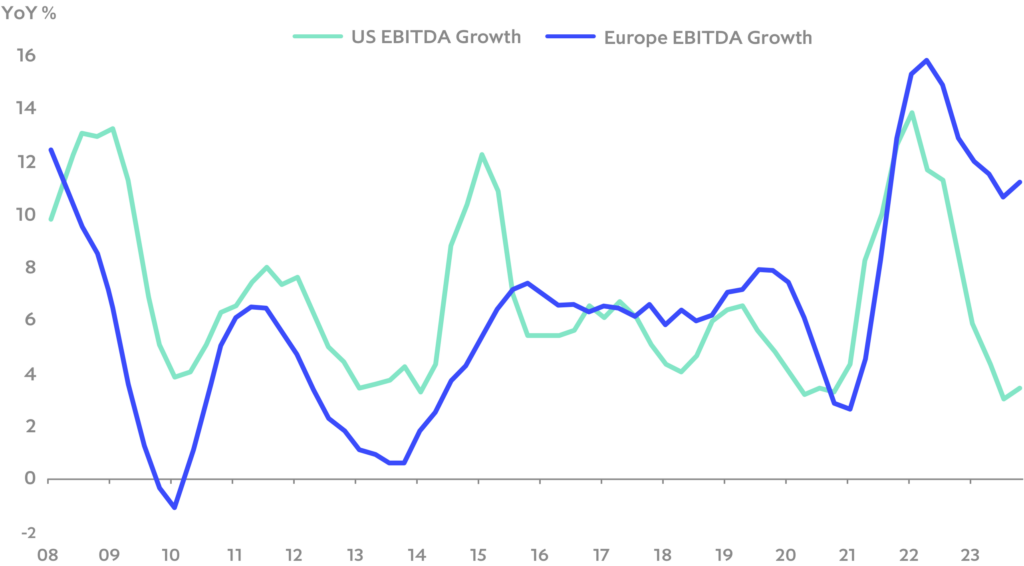

- EBITDA growth re-accelerated in Europe and the US in the second half of 2023 as easing input cost inflation helped to stabilise margins.

- Sector performance divergence was high in 2023. Consumer discretionary and industrials saw the strongest EBITDA growth performance, benefiting from rising household real income growth and normalising supply chains. Chemicals and healthcare were the weakest performers, with margins under pressure, though there were tentative signs that the worst of the margin squeeze may have passed as wage growth slowed and energy costs normalised.

- Debt metrics remain sound, though interest coverage ratios declined in 2023 on continued high interest rates and weaker EBITDA growth. In Europe net leverage continued to decline and the median interest coverage ratio was a still comfortable 3.0x in Q4 2023. US net leverage rose modestly, and the median interest coverage ratio stood at 2.0 in Q4 2023.

- Equity cushions remained substantial, with the equity contribution to enterprise value in the US holding near an all-time high of 50% and 46% in Europe, providing substantial protection to debt holders.

Resilient private company EBITDA growth

US and Europe Private Company EBITDA Growth

Back

Back